The general rule in bankruptcy is that the most recent tax return needs to be turned into the trustee one week before the 341 hearings. Failing to do so can get your case dismissed or if you are lucky the trustee will give you a few days to do it and continue your case. If you comply with the tax return requirement then they will remove the continued date off calender and everything moves forward to you getting a discharge. That is if you file your 2nd credit counseling class along with the B23 certificate where you swear that you took the class and put the certificate number etc. These are some of the things that pro se(clients that represent themselves) forget to do and end up getting their cases dismissed. Looking up the local rules on the bankruptcy court website can help but the more prudent aproach in my opinion is to hire someone to do it for you. As a riverside county bankruptcy attorney I do this every day and make sure that everything is done correctly. Today I was in court for 3 cases and one one of them my client gave me a declaration that they were not required to file tax returns for the previous two years because they made under the 9k IRS limit which allow you to not file. I have dealt with this before with clients just making social security income or low income enough to not file. What I have typically done is just file a declaration claiming them exempt from returns. Today the trustee told me that I was in his opinion still required to mail the most recently filed return which was for 2008. I will do that tomorrow and the case will move forward smoothly. Even a seasoned practitioner can be challenged and he might be right. I find it hard to believe that the trustee would be interested in the income my client made three years ago as its irrelevant to the current bankruptcy case but if that is what he wants then I’ll be faxing that to this office tomorrow. Typically I have my clients file tax returns before we file. I might go back to that.

Articles Posted in Chapter 7 Bankruptcy

How much does it cost to file bankruptcy palm springs, Riverside County

The actual costs to file bankruptcy in Riverside County or anywhere for that matter is $299 for a chapter 7 and $274 for a chapter 13. There are also two classes that are now required by the bankruptcy code and some providers charge up to $50 dollars but I have found two that are reasonable and that you can do for $5 and $15 for the second class. I charge people $30 for an individual and 50 for a joint couple to pull their credit reports which then downloads all creditors into my software. Essentially then for me there are $350 dollars in fees that go out of my pocket to file a case on behalf of my clients. Most bankruptcy attorneys start the fees at $1500 for a chapter 7 and that is just for attorney fees so many are $1850 or more in order to file. I try to start around $1200 for a basic case but if its really simple and not a lot of assets to protect, financing on cars, saving a house from foreclosure etc then I’ve been known to charge $1000 dollars. A typical case for me is 12-15 hours of work and then I have my own cost of running a business so I’m about as reasonable as they come for a qualified bankruptcy attorney. I do all the work myself occasionally using virtual paralegals for data entry and gathering of documents when I get too busy, but I pride myself on having a personal relationship with my clients throughout the whole process. I see the type of work that the bankruptcy mills churn out and they charge as much as I do and there clients only meet there attorney for 30 minutes and then show up at the hearing. Bankruptcy work needs someone that you feel comfortable with and that answers the right questions and best protects you to help you move forward with your fresh start. I vary my prices on a sliding scale and understand what people are going through in this economy and what a personal decision this is so please call my office to find out what chapter to file or if bankruptcy is right for you.

law office of patenaude and felix lawsuit for Credit Card Debt

More and more of my Bankruptcy clients are being sued by The Law offices of Patenaude and Felix. They are based in San Diego and have many California lawyers who sue on credit card debt. If you have been served a summons or are being sued or looking at a default judgment from this law firm then we should look at bankruptcy as a potential option or possibly trying to settle the debt if you can come up with a lump sum payment. Default judgments will allow them to collect 25% of your net income through a wage garnishment and for most people even who make a lot of money a chapter 13 plan will be much less on a monthly basis then the loss of 25% of your wages. If you are below the median income you can do a chapter 7 bankruptcy and most likely keep all your assets. Call my office to find a solution to your legal problems with Patenaude and Felix.

Desert Hot Springs in Riverside County filed for Bankruptcy

Desert Hot Springs is only the second city in the United States to seek Bankruptcy protection. They didn’t pay on a lawsuit that called for them to pay 3 million dollars and decided to file bankruptcy. They were able to come out their bankruptcy by buying bonds and have restored to great financial shape. In 2001 the city had to file because a major part of the debt , approximately $6 million owed to developers and their attorneys who won a Fair Housing Act suit against the city. The city had 8 million in debts it could not pay.

If you live in desert hot springs the median income is around 25,000 dollars and below the states median income which allows people to qualify for chapter 7 bankruptcy in which you can protect at least 23,000 dollars in assets through the wild card exemption and up to 100,000 if you use the homestead exemption. Bankruptcy is not the end as the city of desert hot springs saw but a new beginning. The city is now within its budget and got a fresh start through the bankruptcy code.

Law suits from Zwicker and Associates, Fredrick J. Hanna, Mann Bracken

Mann Bracken LLC , Professional Recovery Services Inc, Receivable Management Inc, Capital Management, Frederick J Hanna and Associates PC, Zwicker and Associates, Hemar and Rousso, are some of the debt collectors that I have had to deal with the most in terms of law suits or law debt collection activities. Zwicker and Fredrick J. Hanna, Mann Bracken are so big that they would rather pursue collection activities and work on settlements, then go to trial quickly. If coming up with a reasonable percentage is something that you can do then settling some of these accounts can be worth your while. If your debts are overwhelming then you really need to look into the bankruptcy laws and realize that most if not all of your assets can be protected.

Sued by Brewer and Brewer or Goldsmith and Hulll?

Have you been sued by Brewer and Brewer or Goldsmith and Hulll? Collection attorneys sucha as Brewer and Brewer, Goldsmith and Hull sue on behalf of credit card companies when people are in default.They often times file numerous cases on a monthly basis and typcially firms hope that you will not answer the summons and the case will result in a default judgment. That is the easiest way for a firm to collect money on behalf of their client. By answering the case, it takes an easy case and turns it into a time consuming and potentially expensive case. If 10% of people answered the cases that some of these law firms file, they would not be able to coninue filing the volume of cases that they do as they would be inundated with actual legal work and document production, discovery requests and court dates. This does not necessarily mean by answering a case that you will win it or they will drop it altogether, but it will allow you to reach a better settlement or buy some time to see if bankruptcy might be a better alternative. If you received a complaint or summons in the mail now is the time to talk with a debt attorney who can help you determine you best way to move forward.

Sued by Rory Clark

Have you been sued by Law Office of Rory Clark? Now is the time to answer the complaint or think about filing bankruptcy. Rory clark collects for Chase cards and other credit card companies by issuing a summons and hoping that you don’t answer. That allows them to get a default judgment and easily collect through a wage garnishment or a lien on real property. Answering the law suit can get you a better settlement and buy you time to make a payment. If that is not possible then you really need to consider the filing of a bankruptcy petition. I have been trying to negotiate with Chase for one of my clients recently as the sued really quickly on a debt. At first Chase legal was handling the account and they served the summons. Once I answered the case it is now being dealt with by Law office of Rory Clark but of course I am not talking with an attorney yet but only a collection agent and she wants to settle the case for essentially the same amount that Chase legal was offering. Getting discovery started will make them realize that it will cost them time and money to aggressively pursue my client and they might not have all the itemized bills and documents to prove the money owed. If they do they will still have to put someone on the stand who is familiar with the case as a witness. All this costs money so hopefully they come to see that accepting a better settlement on behalf of my client is cheaper then the current alternative they are seeking. Bankruptcy is always an option if you have been sued so whether defending a case and answering the complaint is your objective, or seeking bankruptcy relief, call a Riverside bankruptcy attorney today to understand your options.

Don’t be Cheap when it comes to Bankruptcy. Talk to an attorney not a petition preparer

Bankruptcy Petition preparers are cheap but don’t add value to your case.

Be wary of all the advertisments for $200 dollar bankruptcies. While a petition preparer can offer typing services and help put your assets and debts in the right places, and maybe help determine your six months of income necessary to do the means test. They cannot offer legal advise or help you with exemptions. Read this article before turning to a low cost petition preparer. As an attorney I see bankruptcy cases every day and see how the trustee’s look at issues and understand how to protect all your assets and make sure that everything is included so that you get your discharge and not your case dismissed.

Failure to mention a potential asset such as an unresolved personal injury case or employment law case can make it where its subject to the trustee and property of the estate instead of exempt and yours to enjoy and protect.

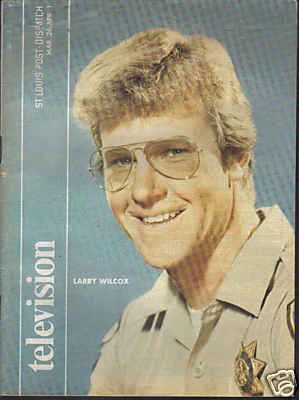

Larry Wilcox from Chips file for Bankruptcy

Former Chips star Larry Wilcox file for Bankruptcy amid criminal charges brought by the SEC. This story was particularly interesting to me as Larry Wilcox was a bit of a hero to me as a kid and over the last 5 years I have been told that I look just like him. He has 1.5 million dollars in debt and owes an enormous amount in back taxes. This case will be interesting to follow as he has also been charged with being a part of an organized company that sold fake stock certificates. Its hard to believe that someone who played the clean role of Chips actor is involved in a criminal enterprise.

Former Chips star Larry Wilcox file for Bankruptcy amid criminal charges brought by the SEC. This story was particularly interesting to me as Larry Wilcox was a bit of a hero to me as a kid and over the last 5 years I have been told that I look just like him. He has 1.5 million dollars in debt and owes an enormous amount in back taxes. This case will be interesting to follow as he has also been charged with being a part of an organized company that sold fake stock certificates. Its hard to believe that someone who played the clean role of Chips actor is involved in a criminal enterprise.

File for bankruptcy while the economy is down don’t wait

Filing for bankruptcy is never an easy decision but if things are starting to get better for you economically but you are still mired in debt then there is no time like the present to get bankruptcy advice from a riverside county bankruptcy attorney. The type of bankruptcy you qualify for depends on your last six months of income and once things start getting better if getting out of previous debt is still a priority, its likely you’ll be in a five year plan and subject to a restricted budget. Chapter 13 offers many benefits but its nice to be able to make the decision to choose between a chapter 7 or chapter 13 and by waiting until your income goes back up, it might be a choice you won’t have.

Riverside County Bankruptcy Lawyer Blog

Riverside County Bankruptcy Lawyer Blog